AXA IM increases engagement in Responsible Investing roadmap by 47% in 2020

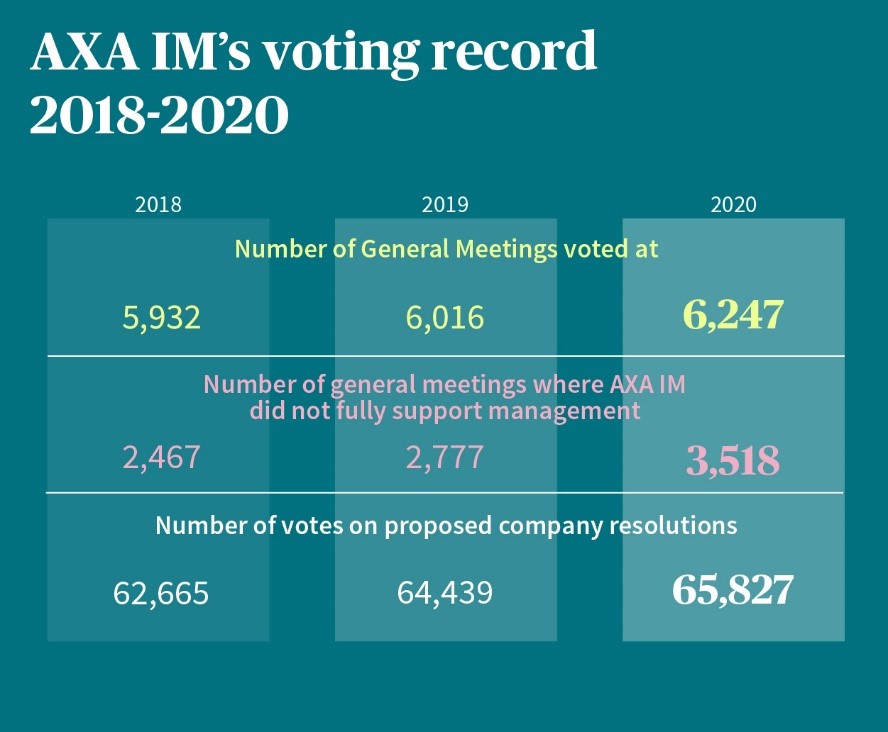

- 319 issuers engaged, 6,247 general meetings voted at, and 65,827 proposed company resolutions voted on in 2020

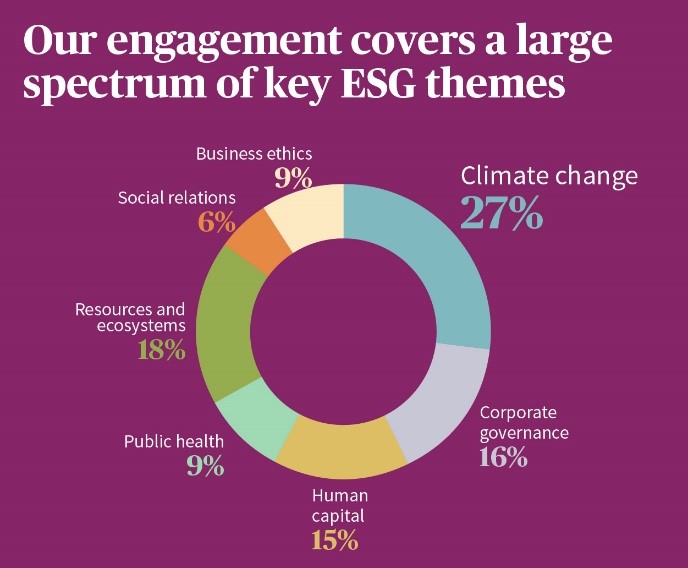

Source: AXA IM, 2020 Active Ownership and Stewardship Report, XX March 2021. . - Climate change accounted for highest proportion of total engagements at 27%

Source: AXA IM, 2020 Active Ownership and Stewardship Report, XX March 2021. . - Over 80% of engagements in 2020 linked to the UN Sustainable Development Goals

Source: AXA IM, 2020 Active Ownership and Stewardship Report, XX March 2021. . - Over 20 engagement milestones reached indicating meaningful corporate changes following successful engagement.

- Climate change, biodiversity loss, diversity, and public health among the key areas for AXA IM’s engagement activities in 2021 and beyond.

AXA Investment Managers (AXA IM) engaged with over 300 issuers throughout 2020, versus 217 issuers in 2019, representing a 47% increase on engagements in 2020 despite the challenging environment caused by the impact of Covid-19.

As detailed in its 2020 Active Ownership and Stewardship Report, AXA IM engaged with corporates in over 50 countries throughout the year, driven by its long-term convictions in areas that it considers most urgent and material for investors. In line with the priorities of its Responsible Investment (RI) roadmap

The report also highlighted that more than 80% of AXA IM’s engagements in 2020 were linked to the UN Sustainable Development Goals (SDGs). In addition, the highest levels of engagement focused on the key ESG themes of climate change (27%), resource & ecosystems (18%) and corporate governance (16%).

AXA IM also recorded over 20 engagement milestones, whereby issuers made meaningful corporate changes following successful engagement efforts, with no engagement failures recorded. These successes include meaningful changes in relation to engagement objectives around climate change, board independence and business conduct. The firm also noted over 30 instances where it had escalated engagement with issuers, leading to filing resolutions at Annual General Meetings, or divestment in certain cases.

AXA Investment Managers’ Global Head of AXA IM Core, Hans Stoter, commented: “Engagement is central to responsible investment at AXA IM. Our dialogue with companies allows us to actively monitor our investments, and to ensure we maintain open channels that can enable change in order to benefit society, the planet and, of course, our clients.

“In 2020, of course, our engagement activities took on a dramatic new challenge caused by COVID-19, and it is a testament to the dynamism of our Responsible Investment experts and portfolio managers that over this tough 12 months, we managed to increase the total number of engagements by 47%.”

Driving positive change in 2021 and beyond

AXA IM will continue to focus on expanding its engagement efforts across areas believed to be most material for investors, including:

Climate change: AXA IM will continue engaging with companies, including those already committed to reducing their carbon footprints, to understand in detail how they intend to achieve their climate objectives, and help ensure they are ultimately aligned with the goals of the Paris Agreement.

Climate change: AXA IM will continue engaging with companies, including those already committed to reducing their carbon footprints, to understand in detail how they intend to achieve their climate objectives, and help ensure they are ultimately aligned with the goals of the Paris Agreement.

Biodiversity loss: AXA IM will look to continue discussions with companies and other investors on biodiversity as it further broadens the scope of its engagement, supported by the selection of its biodiversity data provider in September 2020

Gender equality: Following the launch of the 30% Club France Investor Group in November

Public health: AXA IM will remain focused on promoting responsible behaviour in response to COVID-19 to boost the pace and resilience of the global economy’s recovery from the pandemic, leveraging its partnership with the Access to Medicine Foundation

Marco Morelli, Executive Chairman at AXA Investment Managers, commented:

“In 2020, despite the pandemic providing notable drop-offs in carbon emissions, we remained focused on our efforts to combat climate change largely through several collective engagement initiatives. We have sought to engage where we think we can have an impact, and have also taken significant strides forward in our own low carbon journey, making commitments in line with the demands we make of carbon intensive investee companies.

“We recognise that every action we take has a consequence and we are serious about ensuring that we uphold the same high standards that we expect to see in others as a fiduciary, as an employer and as a partner.”

Disclaimer

Notes to editors

All data and statistics sourced from AXA IM as at 31 December 2020, unless otherwise stated.

About AXA Investment Managers

AXA Investment Managers (AXA IM) is a responsible asset manager, actively investing for the long-term to help its clients, its people and the world to prosper. Our high conviction approach enables us to uncover what we believe to be the best global investment opportunities across alternative and traditional asset classes, managing approximately €858 billion in assets as at the end of December 2020.

AXA IM is a leading investor in green, social and sustainable markets, managing €555 billion of ESG-integrated, sustainable and impact assets. We are committed to reaching net zero greenhouse gas emissions by 2050 across all our assets, and integrating ESG principles into our business, from stock selection to our corporate actions and culture. Our goal is to provide clients with a true value responsible investment solution, while driving meaningful change for society and the environment.

AXA IM employs over 2,440 employees around the world, operates out of 27 offices across 20 countries.

- Visit our website: www.axa-im.com

- Follow us on LinkedIn: https://www.linkedin.com/company/axa-investment-managers

Not for Retail distribution: This document is intended exclusively for Professional, Institutional, Qualified or Wholesale Clients / Investors only, as defined by applicable local laws and regulation. Circulation must be restricted accordingly.

This promotional communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. This material does not contain sufficient information to support an investment decision.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 7 Newgate Street, London EC1A 7NX.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

AXA IM and BNPP AM are progressively merging and streamlining our legal entities to create a unified structure

AXA Investment Managers joined BNP Paribas Group in July 2025. Following the merger of AXA Investment Managers Paris and BNP PARIBAS ASSET MANAGEMENT Europe and their respective holding companies on December 31, 2025, the combined company now operates under the BNP PARIBAS ASSET MANAGEMENT Europe name.