A cutting-edge opportunity

- 26 October 2022 (5 min read)

Biotechnology is a burgeoning specialist field transforming the way we treat diseases. It continues to deliver on R&D pipeline progress and commercial growth despite the macro conditions impacting other, more cyclical sectors. These are the core fundamentals of the expected long-term growth in the sector, and they have arguably been strengthened further during the COVID pandemic.

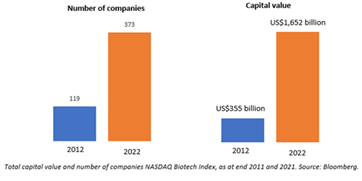

Over the decade from December 31, 2011, to December 31, 2022, the Nasdaq Biotech Index has grown from 119 US-listed biotechnology companies with a combined capitalization of $355 billion to 373 companies valued at over $1.65 trillion (source: Bloomberg). While the sector remains very US-centric, these statistics exclude similar levels of growth in Europe and the rapidly emerging biotech sector in China.

Figure 1: The biotech sector has expanded rapidly over the last decade

In terms of global equities, the biotechnology sector currently makes up around 12% of the MSCI World Healthcare Index and just under 2% of the MSCI AC World Index and S&P5001 .

Blossoming subsector primed for investment

The sector is now the cheapest it has been in two decades by several different metrics. The broader market environment has negatively affected shorter-term trading and, in particular, reduced risk tolerance. As a result, the Nasdaq Biotech Index is now down 30% from its peak and entering its fourth sustained bear market since 19972 . This move is now eclipsing that seen after the 2008 financial crisis and the 2015 bear market following concerns over potential drug reforms (which were never enacted).

Pinpointing the ”bottom” of the market or identifying a catalyst for near-term reversal remain challenging, as so much of the share price movement has been caused by valid macro concerns rather than sector fundamentals. But the history of the sector suggests these market events have presented compelling opportunities for long-term investors. Indeed, following the four bear markets seen in the past, the average share price appreciation from trough to peak has been 332% (Source: Cowen Inc).3

What is biotech?

Topline, biotechnology is the use of living organisms and molecular biology to produce products, typically in the healthcare sector. It is the innovation engine of the biopharma/drugs sector, often sitting at the cutting edge of the next medical breakthrough.

In the early 2000s, the sector was in its infancy, but since then, it has become crucial to the global healthcare industry. The market for pharmaceuticals was once the exclusive domain of large-cap pharmaceutical companies. Today, all the top-10 selling drugs globally are derived from biotechnology/biological products and/or developed by biotechnology companies based on 2021 sales.4

Increasingly, the distinction between biotechnology companies and their pharmaceutical peers has become less defined. Traditional pharmaceutical companies have acquired biotech assets and built on their technology bases to harness the innovation intrinsic to the biotechnology sector.

It has a lower correlation to world equities than healthcare and therefore may offer diversification benefits alongside a healthcare-oriented investment strategy.

Not just start-ups and high-risk disrupters

Overall, the sector is still weighted towards loss-making, early-stage companies. This is where investors may find much of the disruptive innovation, but it is also the more binary, catalyst-driven part of the sector that has the potential to deter investors.

While these innovators are critical to the long-term growth of the sector, it is important to recognize there are more developed companies within the sector. There are also a growing number of high-growth, innovation-driven mid-cap companies with commercial assets and compelling R&D pipeline products.

This mix of defensive top-line growth and pipeline leverage is a potential area for long-term investment.

Case study: Moderna

As an example, Moderna illustrates key characteristics of a biotechnology company. Moderna spent years investing in a new technology, mRNA, that carries genetic instructions to make different proteins that could help our body fight infections or prevent diseases, with a priority focus on vaccines.

This research brought the company to the forefront of COVID vaccine development after the release of the genetic sequence of novel SARS-CoV-2 virus (the underlying cause of COVID) in early 2020. It took just 63 days for Moderna and the US NIH to design, manufacture, quality test and commence clinical studies of their novel COVID vaccine.5 Following efficacy and safety readouts from large clinical trials, which exceeded even the most bullish expectations of what a vaccine could deliver, the product was approved for emergency use in the US within the year.

The World Health Organization (WHO) and European Centre for Disease Prevention and Control (ECDC) estimated that COVID vaccines saved around half a million lives in those aged 60 years and over in the WHO EU region alone in less than a year.6 It was perhaps the only option for ending the global pandemic and Spikevax was the fourth best-selling pharmaceutical in 2021.

The biotechnology industry is most often thought of in relation to pharmaceuticals. Therefore, it is worth remembering there are still no successful, internally developed, commercial COVID vaccines available from the large, incumbent pharmaceutical vaccine manufacturers.

The adaptability and speed of this new biotechnology, combined with the agility and focus of Moderna’s execution, set it apart from large pharmaceutical rivals. The vast majority of these pharmaceutical rivals have since acquired or partnered with smaller mRNA biotech experts to future-proof their businesses.

Risks: All investments are subject to risk. Asset allocation and diversification do not ensure a profit or protect against a loss. There is no assurance that any investment strategy will be successful or that any securities transaction, holdings, sectors or allocations discussed will be profitable.

- TVNDSSBXb3JsZCBIZWFsdGggQ2FyZSBJbmRleCwgU2VwdGVtYmVyIDMwLCAyMDIyOiBodHRwczovL3d3dy5tc2NpLmNvbS9kb2N1bWVudHMvMTAxOTkvYzQxYTczZDEtOTAzNy00ZGJkLWExNzUtNzAzZDNiYjc3YWU2

- TkFTREFRIEJpb3RlY2hub2xvZ3kgSW5kZXg6IGh0dHBzOi8vaW5kZXhlcy5uYXNkYXFvbXguY29tL2luZGV4L292ZXJ2aWV3L05CSQ==

- Q293ZW4gSW5zaWdodHMsIE1hcmNoIDgsIDIwMjIsIOKAnFRoaXMgQmlvdGVjaCBCZWFyIE1hcmtldCBUb28gU2hhbGwgUGFzc+KAnTogaHR0cHM6Ly93d3cuY293ZW4uY29tL2luc2lnaHRzL3RoaXMtYmlvdGVjaC1iZWFyLW1hcmtldC10b28tc2hhbGwtcGFzcy8mbmJzcDs=

- RmllcmNlIFBoYXJtYSwgTWF5IDMxLCAyMDIyLCDigJxUaGUgdG9wIDIwIGRydWdzIGJ5IHdvcmxkd2lkZSBzYWxlcyBpbiAyMDIx4oCdOiBodHRwczovL3d3dy5maWVyY2VwaGFybWEuY29tL3NwZWNpYWwtcmVwb3J0cy90b3AtMjAtZHJ1Z3Mtd29ybGR3aWRlLXNhbGVzLTIwMjE=

- IE1JVCBTbG9hbiBNYW5hZ2VtZW50IFNjaG9vbCwgQXByaWwgMywgMjAyMCwg4oCcSG93IE1vZGVybmEgaXMgcmFjaW5nIHRvIGEgY29yb25hdmlydXMgdmFjY2luZeKAnTogaHR0cHM6Ly9taXRzbG9hbi5taXQuZWR1L2lkZWFzLW1hZGUtdG8tbWF0dGVyL2hvdy1tb2Rlcm5hLXJhY2luZy10by1hLWNvcm9uYXZpcnVzLXZhY2NpbmU=

- RXVyb3BlYW4gQ2VudGVyIGZvciBEaXNlYXNlIFByZXZlbnRpb24gYW5kIENvbnRyb2wsIE5vdmVtYmVyIDI1LCAyMDIxLCDigJxXSE8vRUNEQzogTmVhcmx5IGhhbGYgYSBtaWxsaW9uIGxpdmVzIHNhdmVkIGJ5IENPVklELTE5IHZhY2NpbmF0aW9uIGluIGxlc3MgdGhhbiBhIHllYXLigJ06IGh0dHBzOi8vd3d3LmVjZGMuZXVyb3BhLmV1L2VuL25ld3MtZXZlbnRzL3doby1lY2RjLW5lYXJseS1oYWxmLW1pbGxpb24tbGl2ZXMtc2F2ZWQtY292aWQtMTktdmFjY2luYXRpb24=

Disclaimer

Companies shown are for illustrative. This page is for informational purposes only and does not constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services and should not be considered as a solicitation or as investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorized and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2022 AXA Investment Managers. All rights reserved